Let's talk loans in Malaysia! Have you been thinking about the perfect car or a comfortable home? Whatever it was, you might have considered a loan to make it happen! Loans can be a helpful tool to make these dreams come true, but with a big BUT. Before jumping in headfirst, it's crucial to equip yourself with adequate information to ensure your dream purchase fits your long-term financial goals.

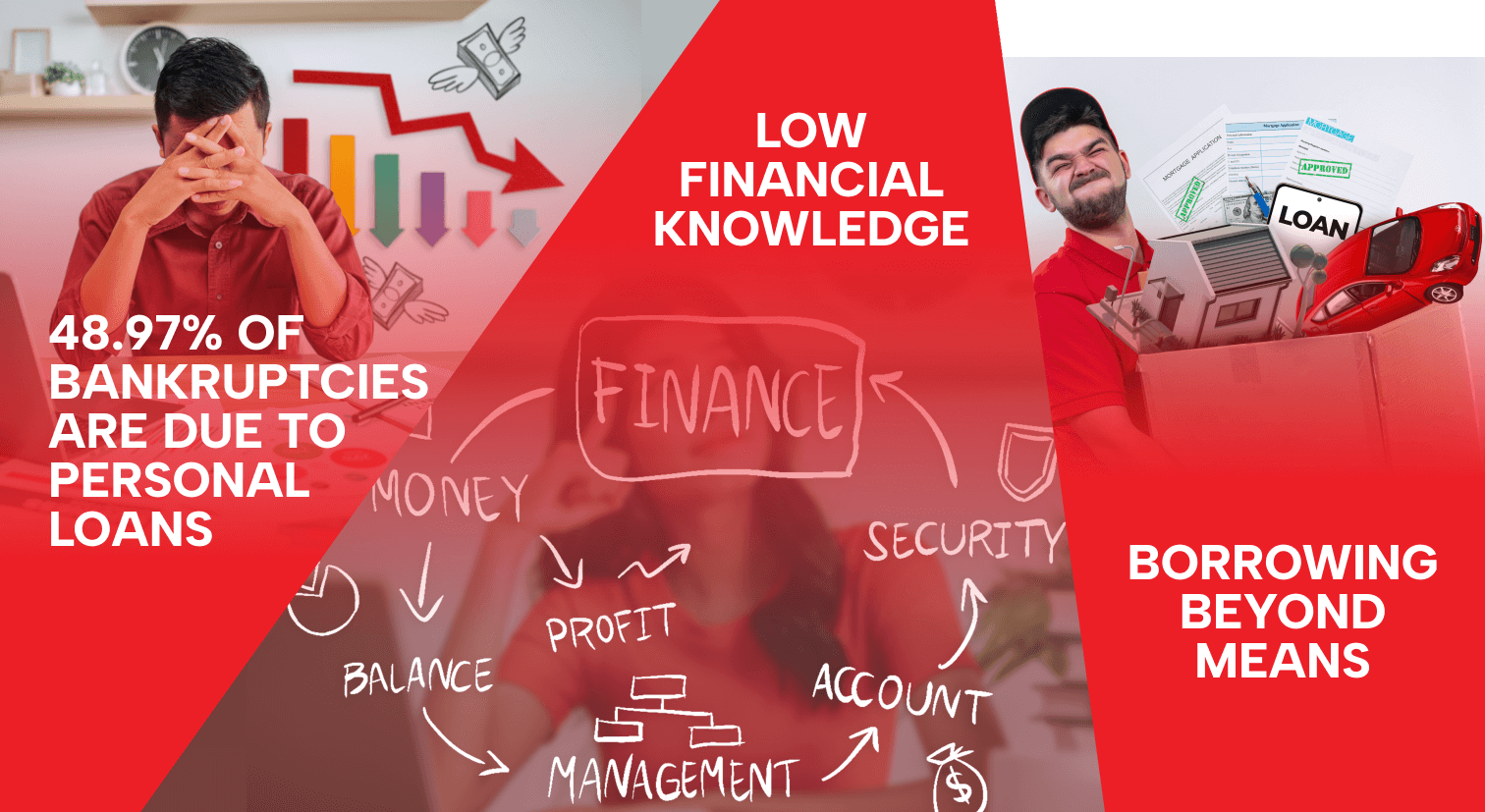

The high household debt-to-GDP ratio in Malaysia illustrates how prevalent loans are; however, a hidden gap exists: many people lack the necessary knowledge to navigate this complex world of loans. This lack of awareness can unfortunately lead to individuals falling prey to unethical practices and accumulating excessive debt which results in:

Before you consider taking the leap, take a moment and ask yourself these crucial questions:

- Do you truly need this loan?

Could saving, exploring grants or financial aid achieve your desired outcomes? - Are you aware of all the associated costs?

Interest rates, fees and potential penalties can add up quickly, understanding full financial commitment is vital. - Are you comfortable with the level of debt and its impact?

Consider how the loan will affect your long-term financial goals and overall financial well-being.

While self-evaluation is crucial for clarifying your needs and making informed decisions, life throws curveballs. Sometimes, despite our best efforts, loans become a necessity. If you are in such situations, remember to plan smartly and be prepared by:

Empowering Malaysians with Transparency: MoneyX and the Know Your Loan Limit Campaign:

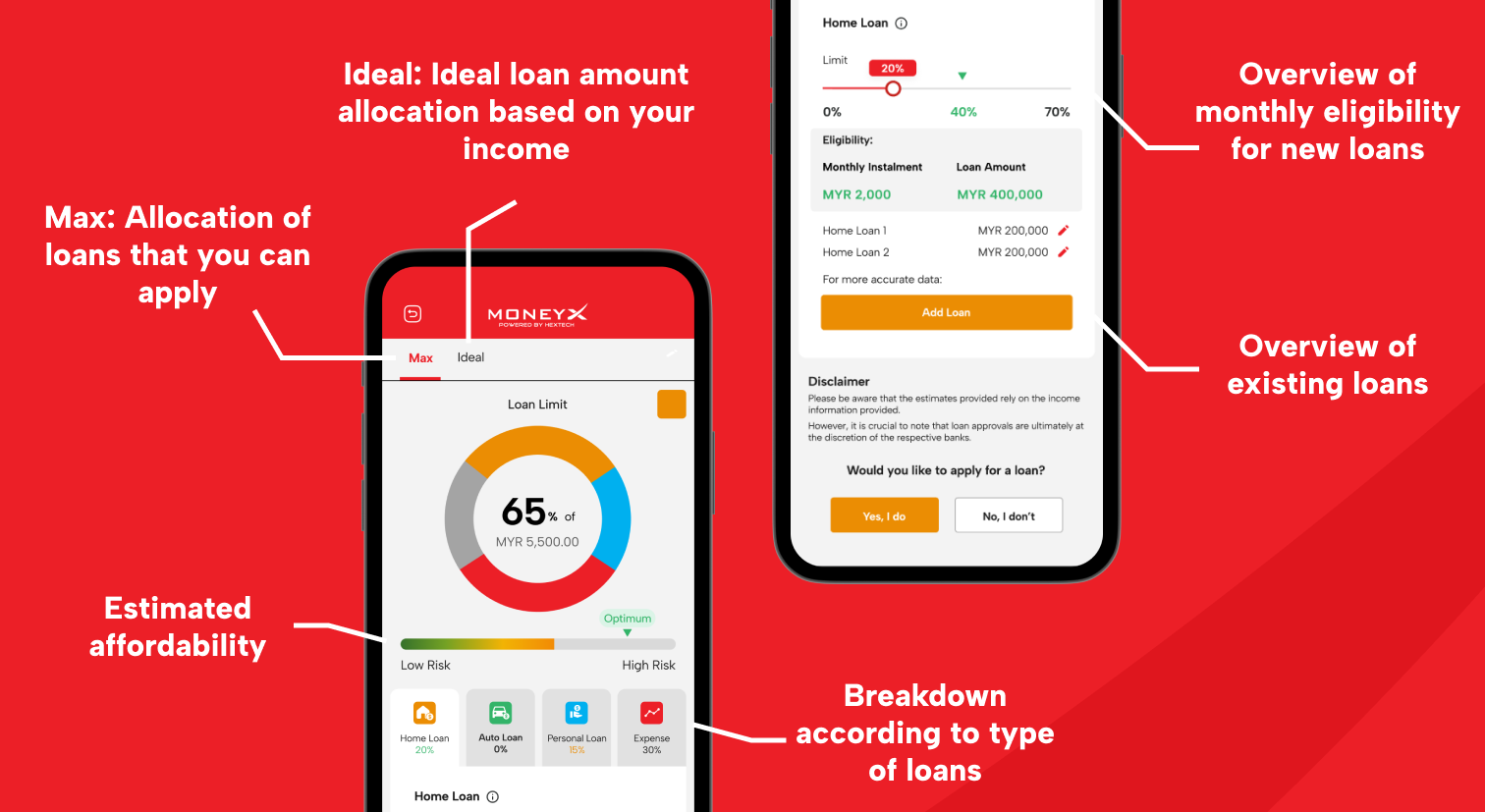

Empowered by knowledge? You’re now ready to confidently explore your loan options. MoneyX, through their Know Your Loan Limit campaign, offers valuable resources to help you navigate through the next steps. This secure platform allows you to estimate your loan eligibility within minutes, providing valuable insights into the loans that are best suited to your needs.

Unlock Your Borrowing Potential with Transparency:

By uploading their EPF statement, users can gain instant access to an AI-personalised loan limit estimate and tailored loan recommendations from a network of trusted banks. This transparency empowers Malaysians to:

- Make informed borrowing decisions: Equipped with knowledge about their financial capacity, individuals can apply for loans confidently, avoiding over-extension and potential debt problems.

- Negotiate with confidence: Knowing their loan limit allows borrowers to enter loan negotiations with a stronger bargaining position and secure more favorable terms.

The Know Your Loan Limit campaign goes beyond mere loan eligibility assessment. It seeks to cultivate a culture of financial literacy across Malaysia as it empowers you to:

- Estimate your loan limit through our secure platform.

- Explore personalised loan recommendations from trusted banks.

- Access valuable financial education resources to boost your financial literacy.

Knowledge is power, and responsible borrowing can be a tool for achieving your financial goals. By following these tips and leveraging resources like MoneyX, you can confidently navigate the loan landscape and pave the way for a brighter financial future.

Analyze your income, expenses, and cash flow to understand your financial situation.