Let’s face it, when it comes to personal finances – many Malaysians especially younger people tend to struggle with personal finance. Balancing bills, responsibilities, and having that dream vacation seems perpetually out of reach. Temptations lurk around every corner, but don’t worry – your EPF can be your financial BFF, not just a rainy day fund.

Isn’t EPF just for retirement? Not quite! While it’s crucial for your golden years, your EPF account can also be your safety net for specific situations like housing withdrawal or critical illness when you make an EPF withdrawal. Think of it as a multi-purpose financial tool, always there to support you. However, here’s the harsh reality.

- 6.3 million of Malaysians under the age of 55 have less than RM10,000 in their EPF account, enough for maybe a few months of living, not a comfortable retirement.

- Even at retirement age, many struggle, leaving them vulnerable financially with over 94,000 members nearing retirement age (54) facing the same situation.

- A whopping 4,810 individuals went bankrupt in Malaysia in 2023 alone, according to the Malaysian Insolvency Department (MID).

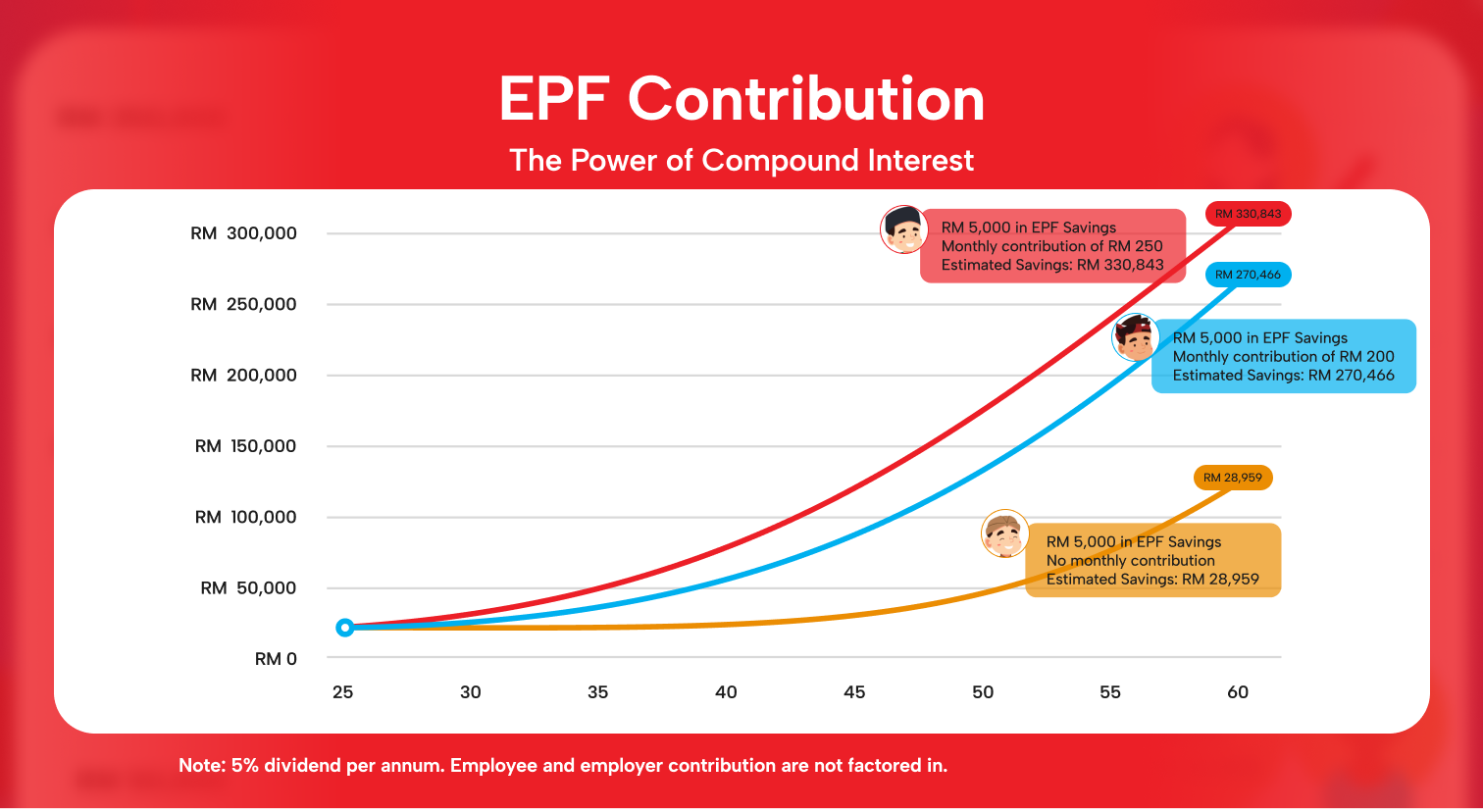

Don’t let yourself become another statistic, make EPF your BFF in financial stability. Why? Because of the power of compound interest. Imagine your money multiplying like bunnies, generation after generation, all thanks to regular EPF contributions and compound interest.

If you put a lump sum of RM 5,000 contribution in your EPF account at the same age and dividend rate. While this seems like an equivalent option, your final EPF value would only be around RM 28,959 by retirement.

The difference is monthly EPF contributions benefit from compound interest on a growing base. Each new contribution earns interest not only on itself but also on the previously accumulated amount. In contrast, a one-time lump sum EPF contribution or not increasing the EPF account only earns interest on the initial investment, missing out on the compounding effect over time.

Remember, consistency is key with regular contributions, even small ones, which are the fuel that keeps your EPF afloat. Don’t wait for a ‘perfect’ time – start small and watch your savings grow.

So, how can you make your EPF your BFF?

- Start contributing, even if it’s in a small amount.

- Increase your EPF contributions gradually as your income grows.

- Avoid unnecessary EPF withdrawals to maximise growth.

- Take advantage of government incentives for additional contributions.

- Review your statements regularly and track your progress.

- Get financial management apps such as MoneyX to track your personal finances. Remember, financial literacy is key to adulting like a boss.

Curious about your finances? Features that MoneyX’s FinAnalysis can offer:

- Insights into your financial habits.

- Clear view of your income, expenses, and savings.

- Tracking progress towards your goals.

- AI-powered suggestions for improvement.

- Informed planning guidance.

Don’t forget to celebrate your wins, big or small. Every contribution brings you closer to financial freedom. Now go forth and conquer your adulting journey with your trusty EPF BFF by your side!