Here’s a simple, step-by-step guide to help young adults for long-term success.

Under Your Financial Situation

Before making any plans, it’s important to know where you stand financially. Take a good look at your income, expenses, debts, and any savings you already have.

- List your monthly income sources, including your salary or freelance earnings.

- Track your expenses to see where your money goes—essentials like rent and food, and non-essentials like subscriptions or dining out.

This gives you a clear picture of how much you have left to save or invest.

Set Clear Financial Goals

Think about what you want to achieve in the short and long term. Your goals might include:

- Building an emergency fund.

- Saving for a trip or a major purchase.

- Paying off student loans or credit card debt.

- Investing for the future or planning for retirement.

Be specific with your goals and set a timeline for achieving them. For example, “Save RM5,000 in one year for an emergency fund” is clear and actionable.

Create A Budget You Can Stick To

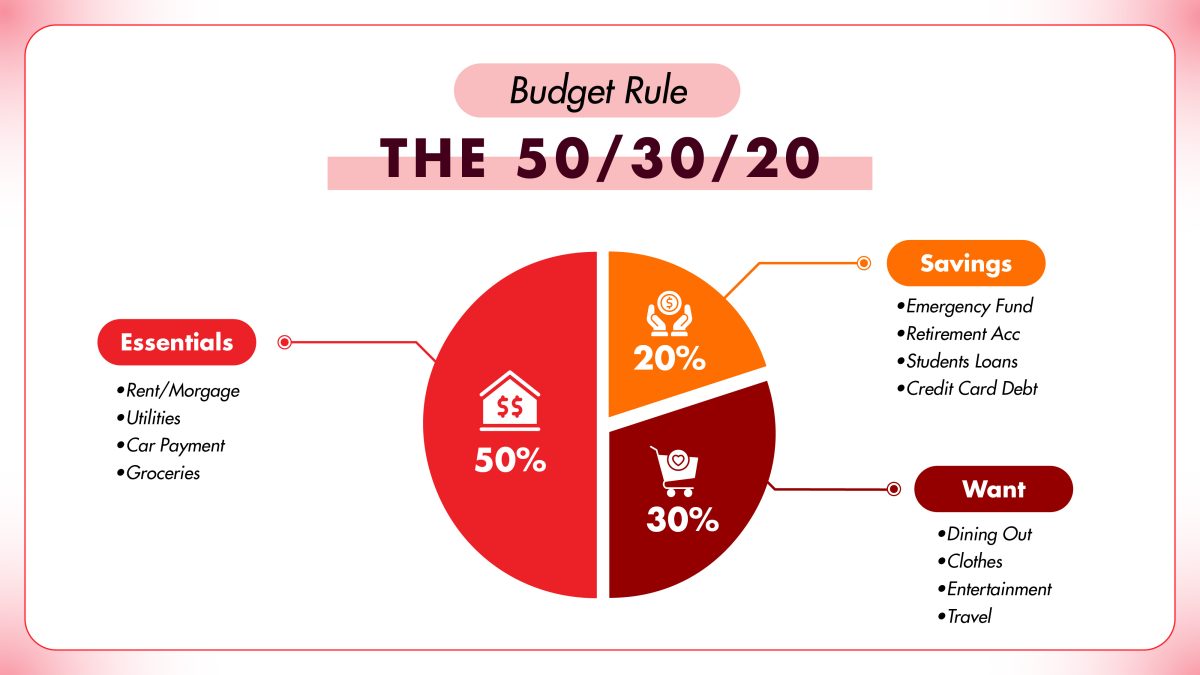

A budget helps you manage your money without overspending. Use the 50/30/20 rule as a starting point:

- 50% for essentials (rent, groceries, bills).

- 30% for lifestyle expenses (dining out, hobbies).

- 20% for savings or debt repayment.

Adjust the percentages if needed, but make sure you’re allocating something to your savings every month.

Build An Emergency Fund

Life is unpredictable, and having a safety net is crucial. Aim to save at least three to six months’ worth of living expenses to cover unexpected costs like medical bills or job loss. Start small if needed—saving even RM100 a month can grow into a substantial fund over time.

Tackle Debt Strategically

If you have student loans, credit card balances, or personal loans, make a plan to pay them off. Focus on high-interest debts first, as they cost you more over time. Consider strategies like:

- The Debt Snowball Method: Pay off the smallest debts first for quick wins.

- The Debt Avalanche Method: Pay off the highest-interest debts first to save money.

Avoid taking on new debt unless absolutely necessary.

Start Saving for the Future

It’s never too early to start planning for long-term goals like retirement. If available, take advantage of any employer-matching retirement programs, and consider contributing to EPF (Employees Provident Fund) voluntarily if you’re self-employed.

Even small contributions to investments or savings plans can grow significantly over time thanks to compound interest.

Explore Investment Options

Investing can help grow your wealth beyond traditional savings. Start with beginner-friendly options like:

- Amanah Saham Nasional Berhad (ASNB) funds.

- Robo-advisors for automated investing.

- Unit trusts or ETFs.

Learn about the risks and rewards of investing, and only invest money you won’t need in the short term.

Protect Yourself with Insurance

Financial planning isn’t just about growing wealth—it’s also about protecting it. Ensure you have basic insurance coverage, including health, life, and critical illness policies. In Malaysia, medical costs can be high, so health insurance is particularly important for young adults.

Educate Yourself

Financial planning is a skill you’ll need throughout life. Take time to educate yourself about money management, investments, and financial products available in Malaysia. Free resources, workshops, and online tools can help you build confidence in managing your finances.

Monitor and Adjust Your Plan

Your financial situation and goals will evolve over time. Regularly review your budget and progress toward your goals, and adjust as needed. Life changes like getting a new job, buying a home, or starting a family will require you to revisit your financial plan.

Financial planning doesn’t have to be complicated. By understanding your financial picture, setting clear goals, and taking consistent steps like budgeting, saving, and investing, you can build a strong foundation for your future. Starting early gives you a significant advantage, so take that first step today—your future self will thank you!