Nobody enjoys scrambling for receipts at the last minute, but guess what? Tax season is back! Whether you’re a pro or a newbie, let’s hope no tears will be shed. With some helpful tips, you can conquer your return and get that refund (if applicable) faster.

Do I Need to File Taxes?

The short answer? It depends. You must file if your annual income (after EPF deductions) exceeds RM34,000 in 2023. In other words, those who earn a minimum of RM2,833 should file their income tax. This applies to all individuals, including salaried employees, freelancers, and business owners. But even if you earn less, filing can establish a positive filing history, potentially benefiting you in the future (e.g., applying for loans or government assistance).

Did You Know?

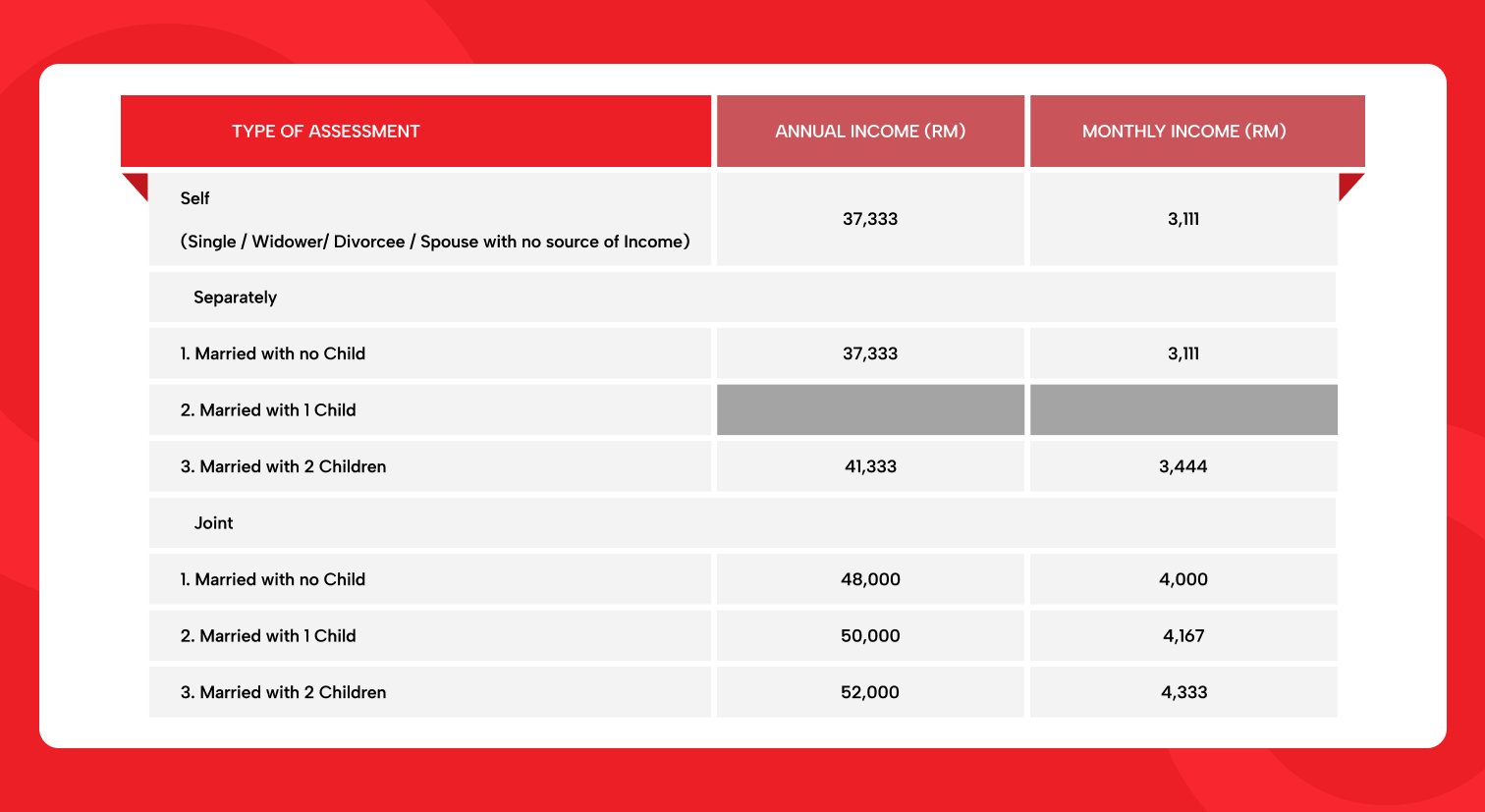

RM34,000 threshold is just the starting point for Malaysian taxes. The actual amount you owe depends on your “taxable income” after deductions and rebates. These can give you a significant break! Think of it as lowering the amount you’re taxed on. For example, married couples with kids get more deductions, meaning they can earn more before taxes kick in. The amount of these deductions depends on your situation (single, married, number of children), refer to the table below:

Filing Methods

While manual submission of tax forms is still an option, the Inland Revenue Board (LHDN) recommends e-Filing for its speed, convenience, and reduced risk of errors. This means you can expect faster processing times and fewer delays with e-Filing.

Important Dates

Filing season: Start filing your returns anytime from March 1, 2024.

Deadlines

April 20, 2024 (manual) or May 15, 2024 (e-Filing)

You can view the full timeline for the YA 2023 tax program here.

What Do You Need to Register for as a First Timer

As a first-time taxpayer, you can register at the nearest LHDN branch via e-Daftar on the MyTax or ezHASiL portal.

If you are walking into the nearest LHDN branch…

Please bring along:

- A copy of Identification Card

- Income Statement / Latest Pay Slip

For Newbies: How to Register for the First Time

Please remember you must be a registered taxpayer before registering for the e-Filing.

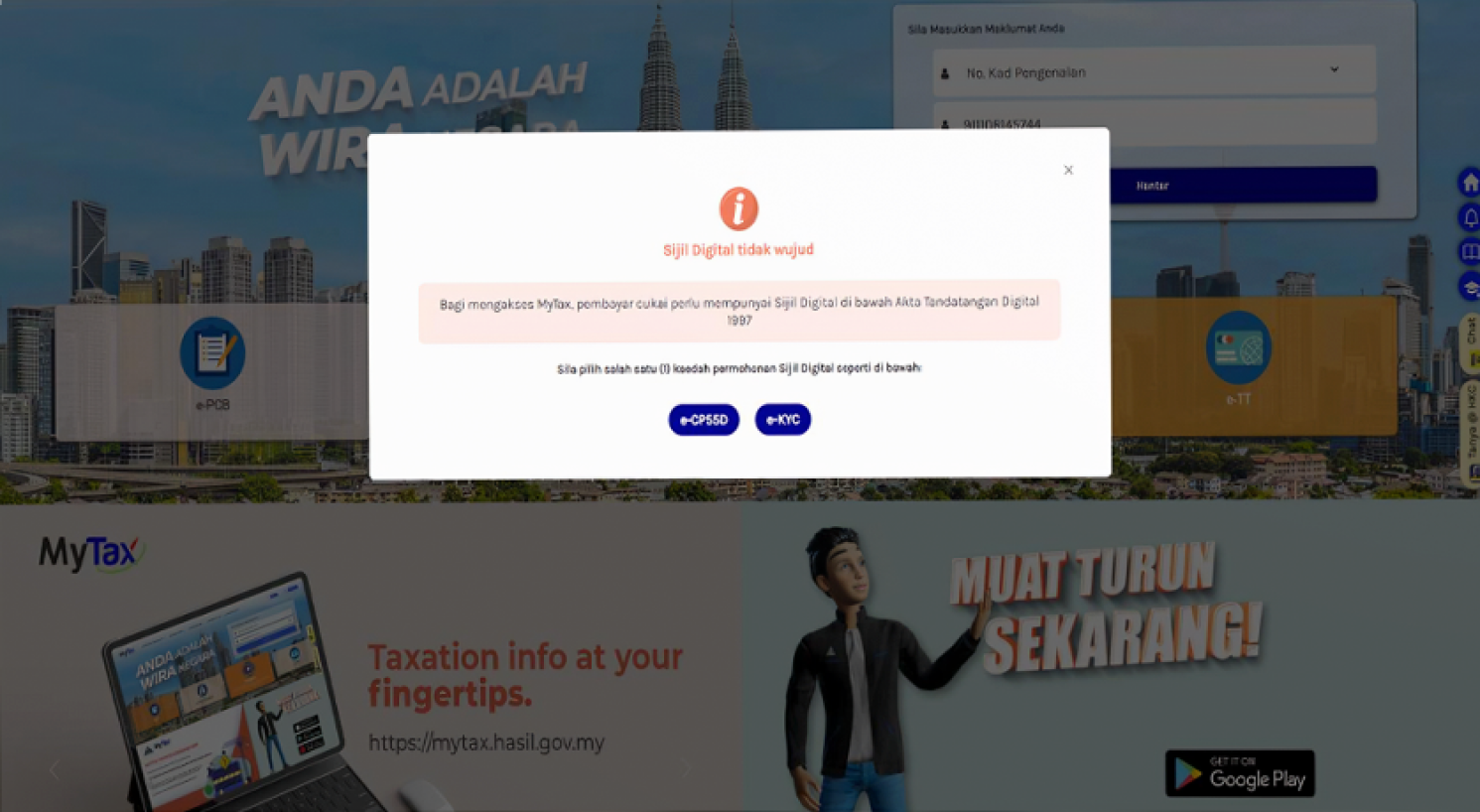

- The system would display “Digital Certificate does not exist”

- Select (1) method to continue registration of a digital certificate

a) e-CP55D

b) e-KYC - Select

a) e-CP55D to continue digital certificate registration via web.

b) e-KYC to continue digital certificate via face identification.

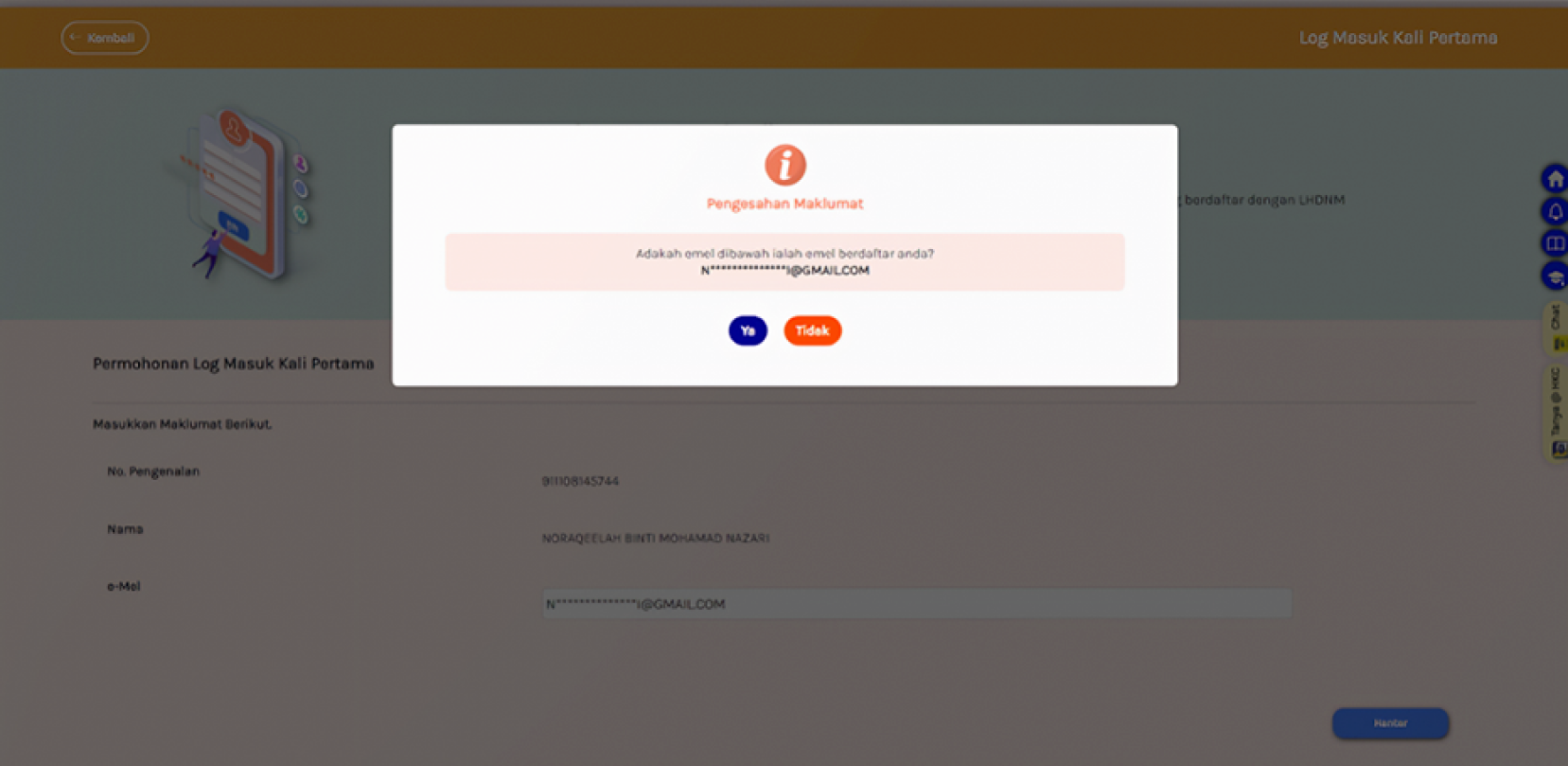

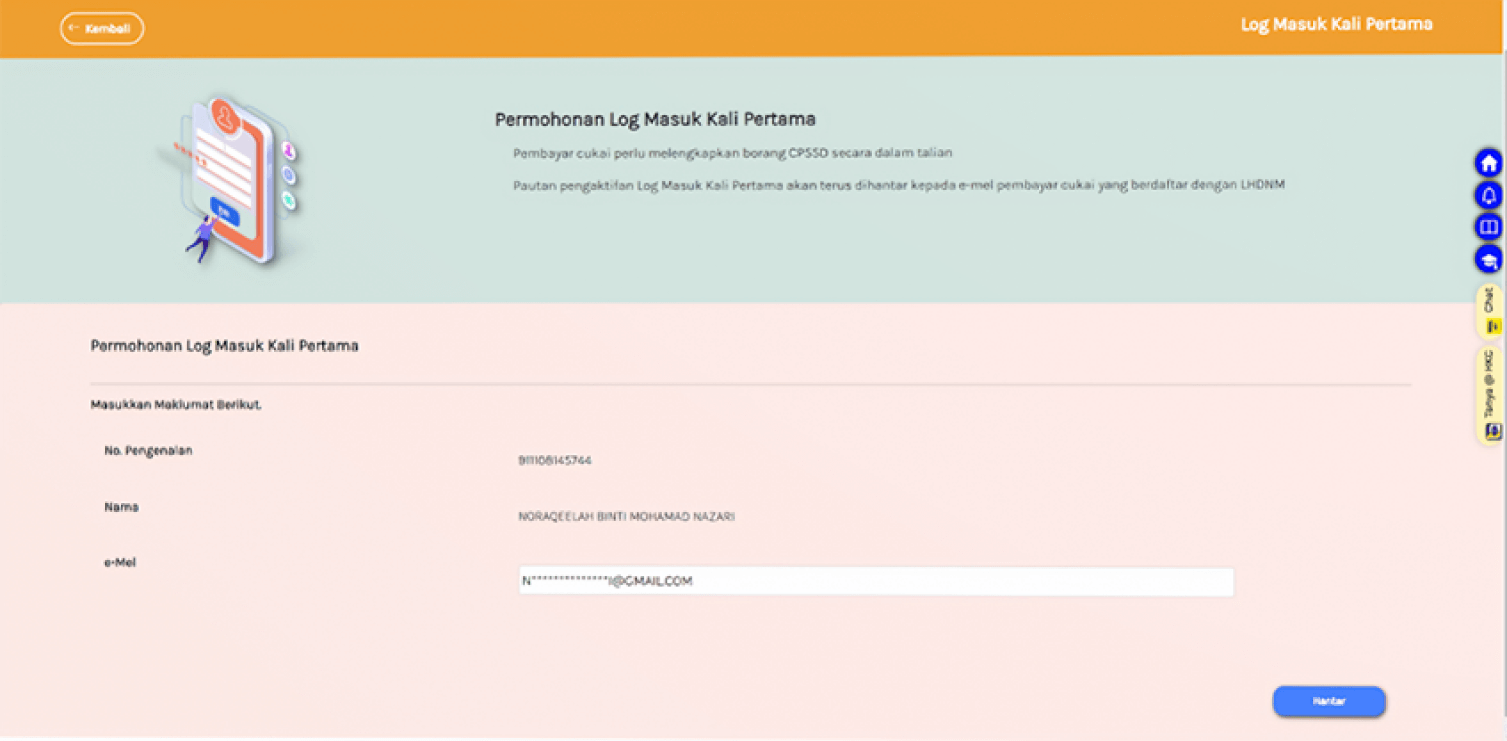

- Click “E-CP55D” and user will be to the “Confirmation of information” page.

- Click “Yes” if it is the registered email or “No” if it is not.

- If you would need to update your email address you can do via

- Online via e-Kemaskini

- Customer Feedback Form

- Visit the LHDN office that handles your income tax

- Identification Number

- Full Name

- Click “Send” if the information is correct.

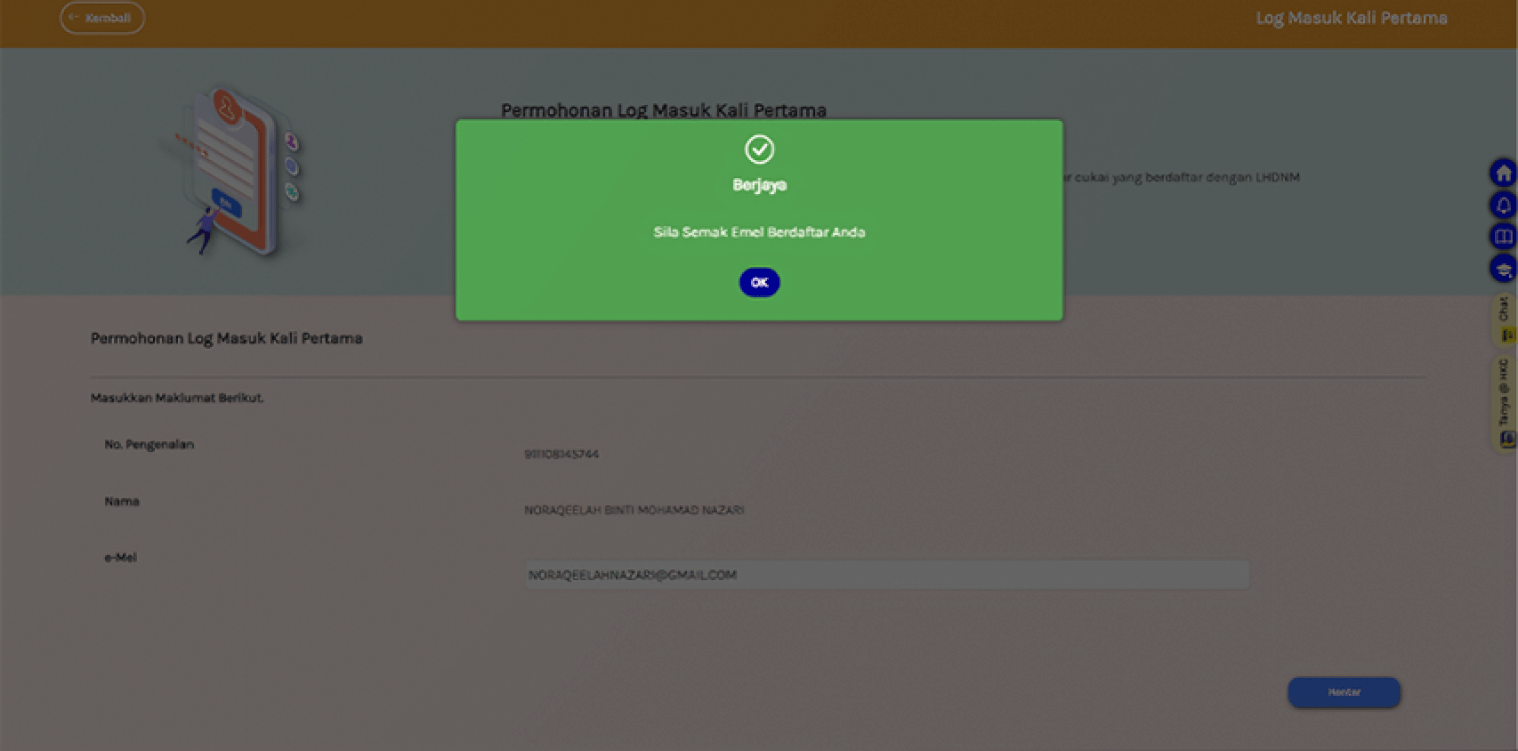

- Success notification will be displayed, and activation link will be sent to the registered email.

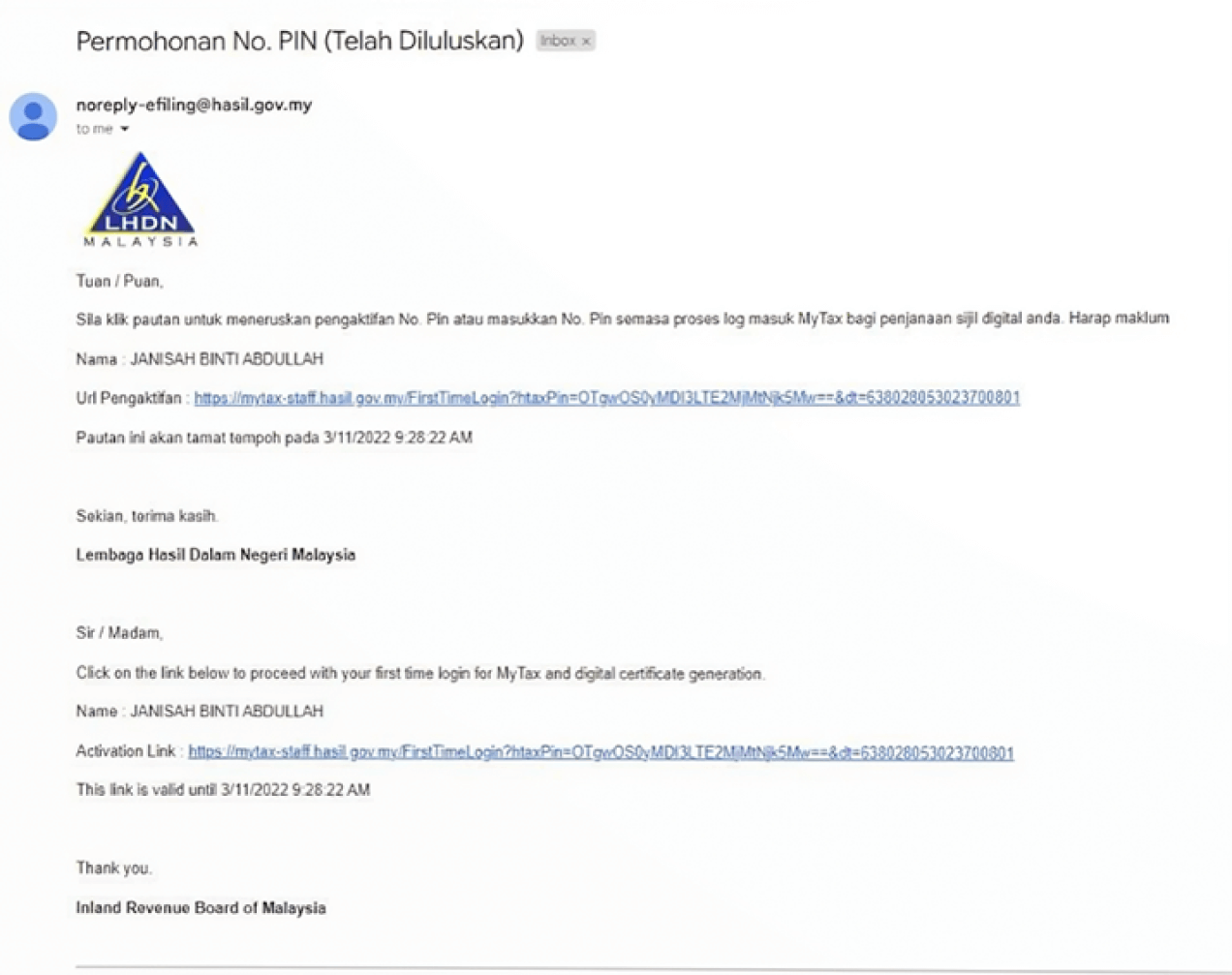

- Click the link to active the digital certificate, bear in mind the link is only valid for two (2) days.

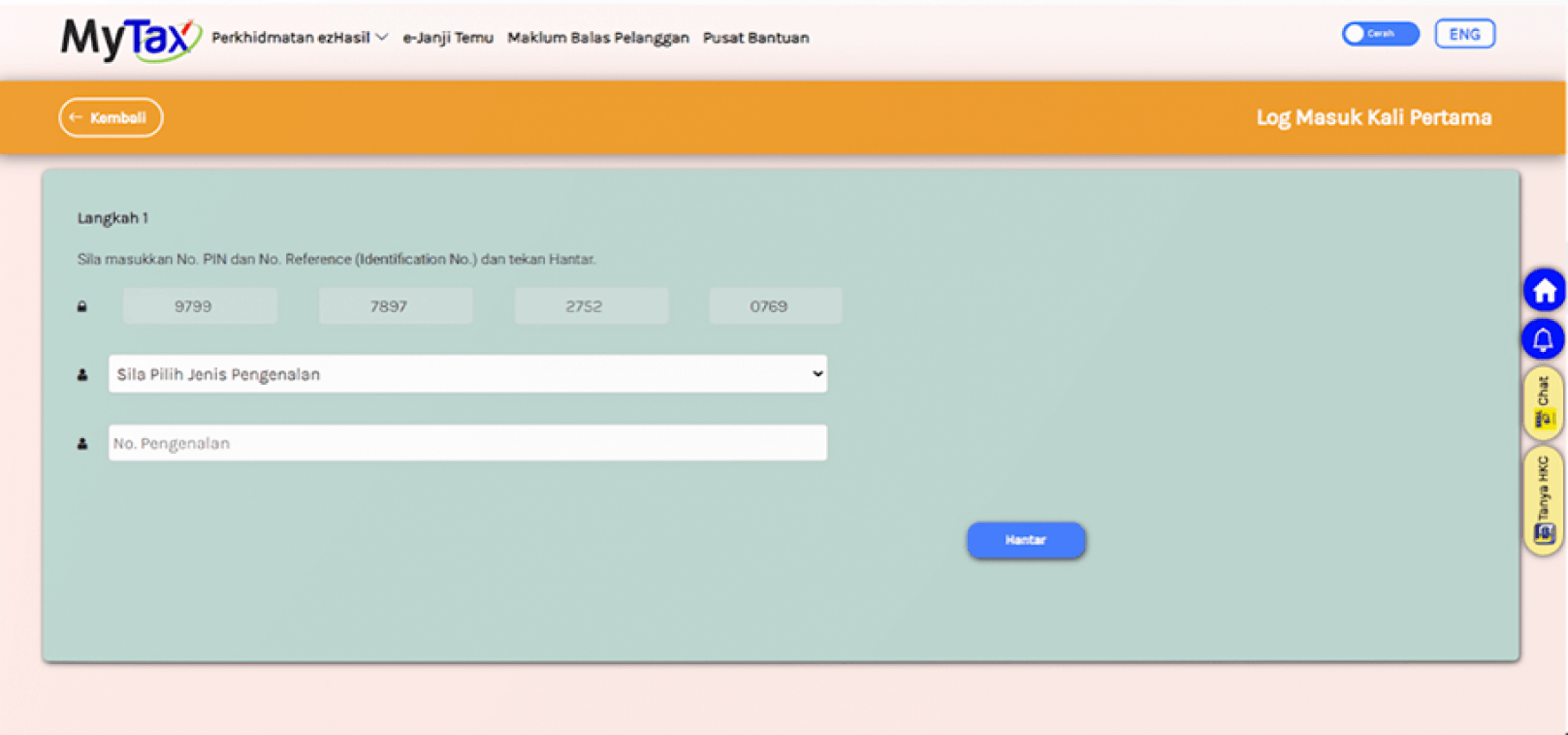

After completing the above steps, you will need to register your digital certificate by clicking the link sent to your email, you will be redirected to the landing page below. You would need to:

- Select your preferred “Identification Number”, enter and click send.

- PIN Number will be displayed

- Select the “Identification type” and enter identification number and click send

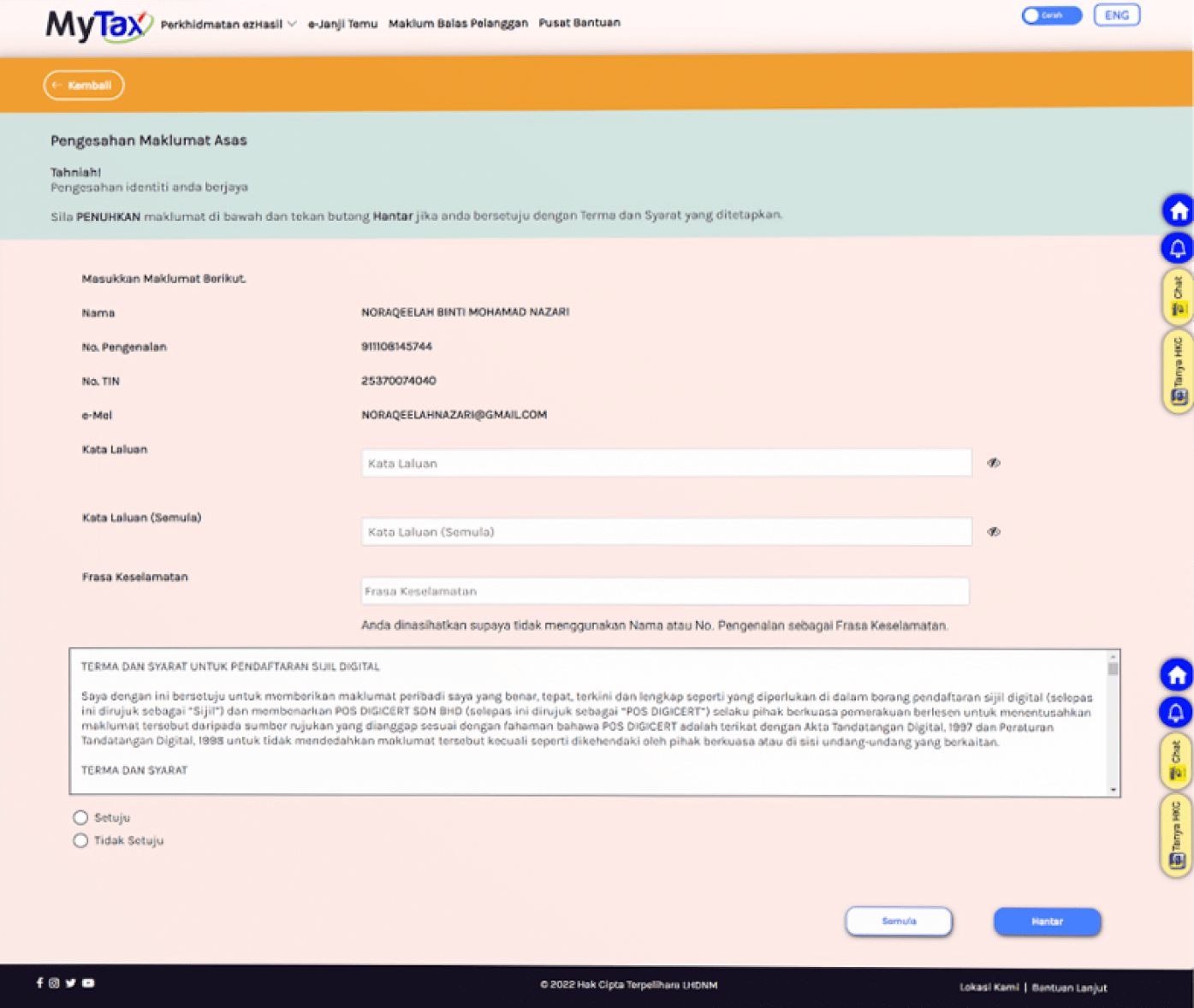

- Verify the displayed information

- If true, create a password and re-enter the password

- Create “Security Phrase”

- Click “Agree” on term and conditions

- Click “Submit”

- Click “Reset” to make any changes to password or security phrase

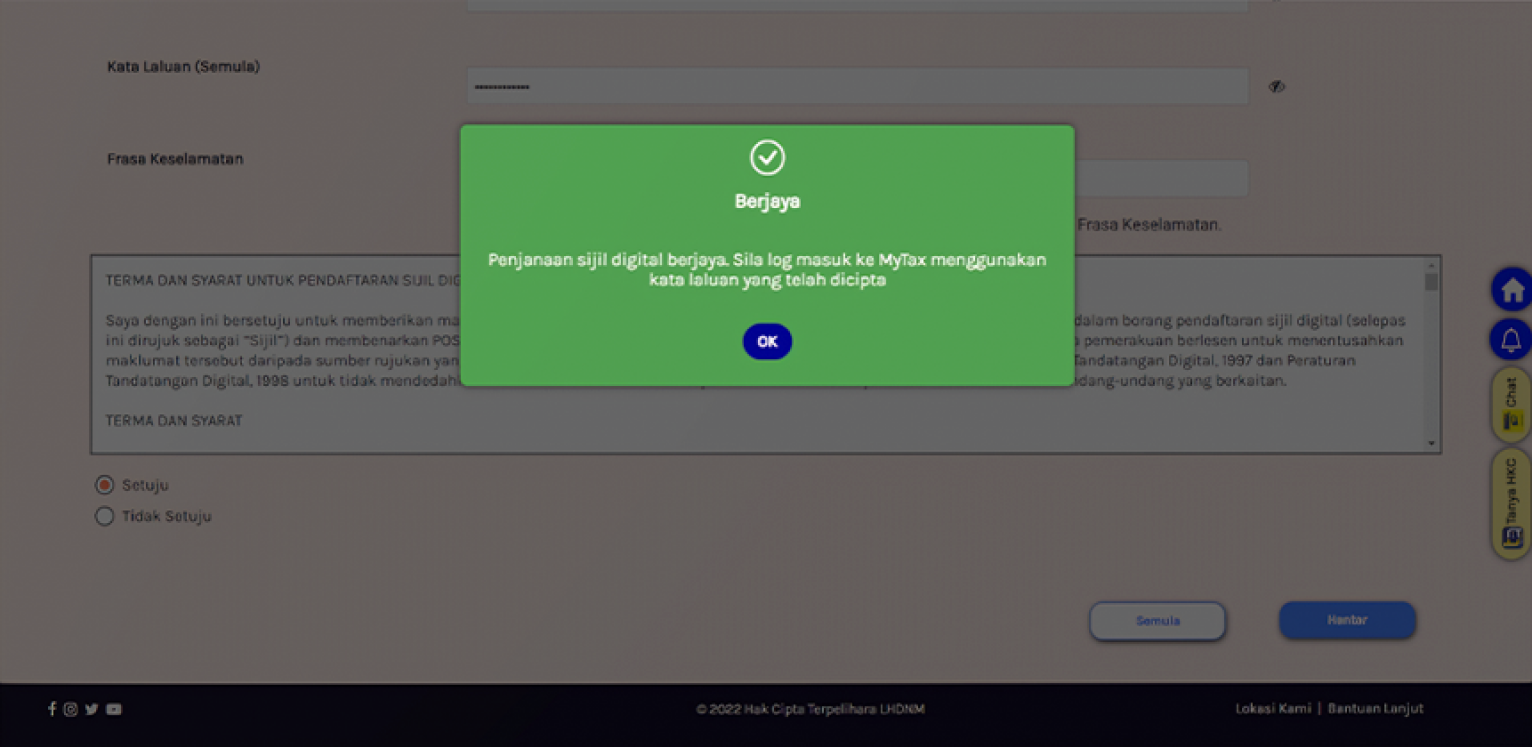

- “Digital Certificate created successfully” is displayed

- Click “OK” to proceed

Great Job! You are now ready to start your e-Filing.

What You’ll Need for e -Filing

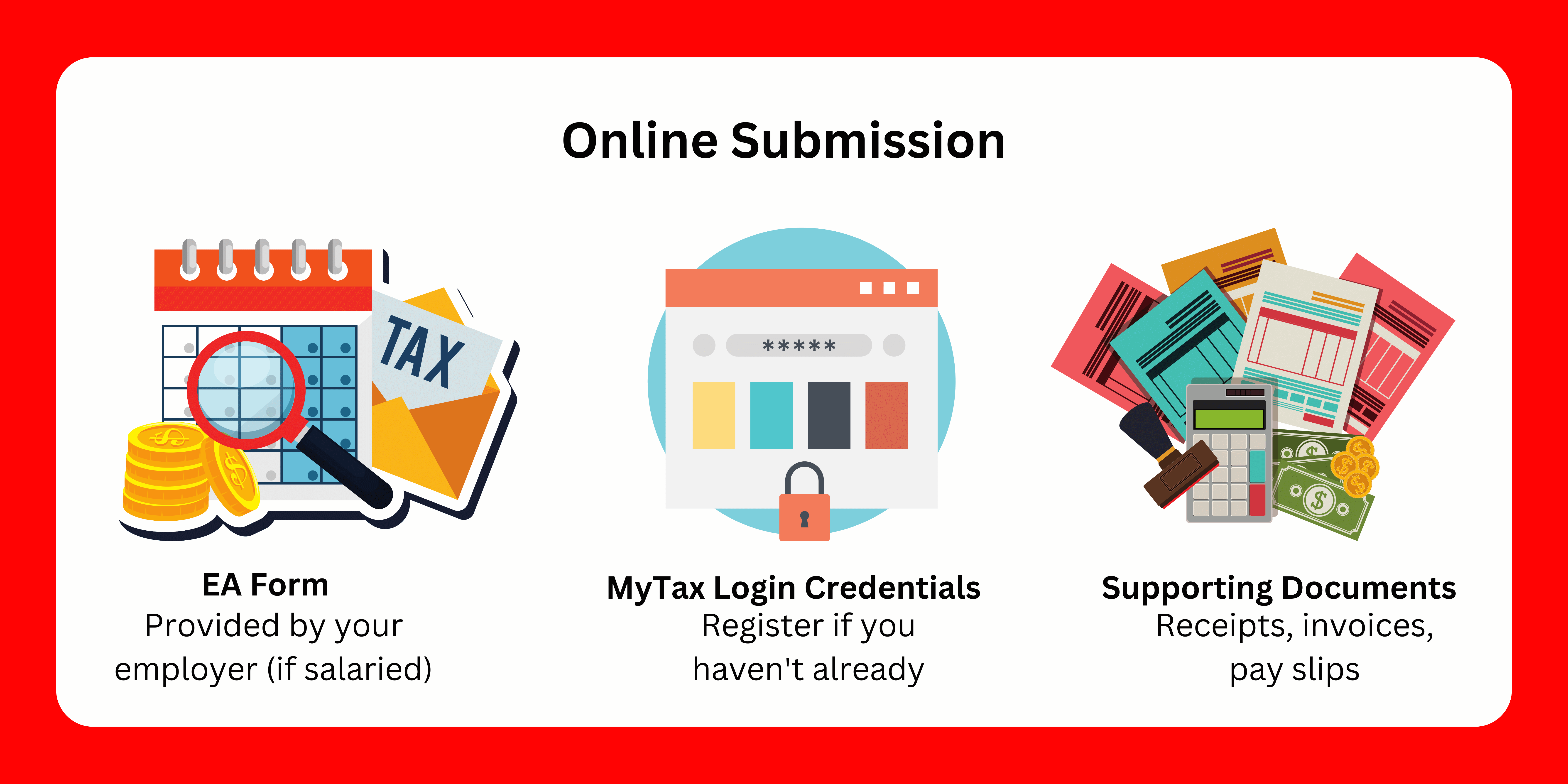

Online Submission

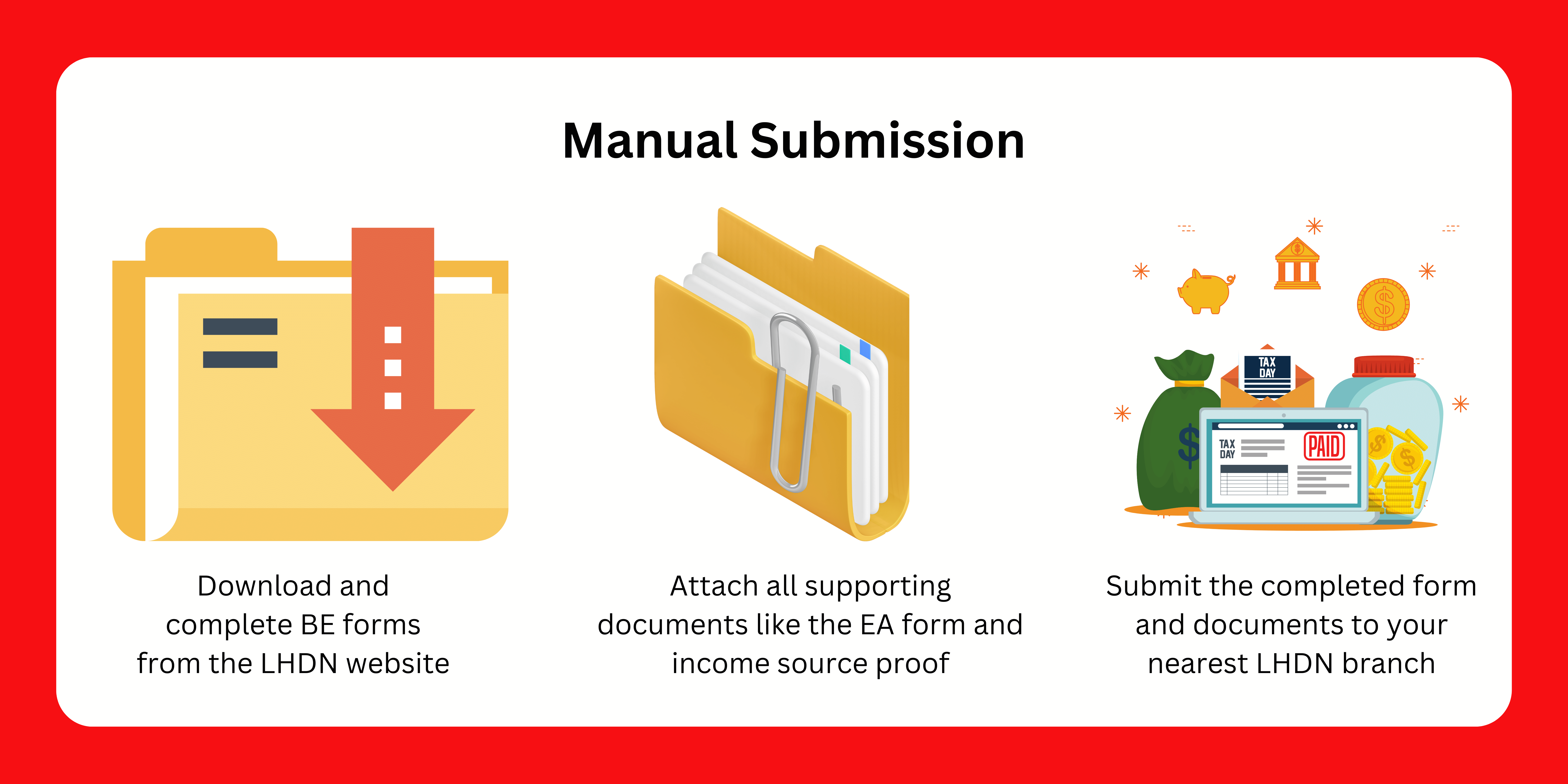

Manual Submission

Need Help?

- LHDN website: https://www.hasil.gov.my/en/contact-us/

- HASiL Contact Centre: Call +603-8888-2787 during operating hours.

- LHDN branch offices: https://www.hasil.gov.my/en/contact-us/walk-in-to-our-office/location/

- Seek help via their online chat assistance,

Conclusion

Don’t let tax season stress you out! While filing your income tax return might seem like a hurdle, this guide is here to help you quickly clear it. With the right resources and a step-by-step approach, navigating the process can be smooth and even (dare we say) satisfying! The key is to start early. The sooner you gather your documents and familiarize yourself with the steps, the less stressful the experience will be.