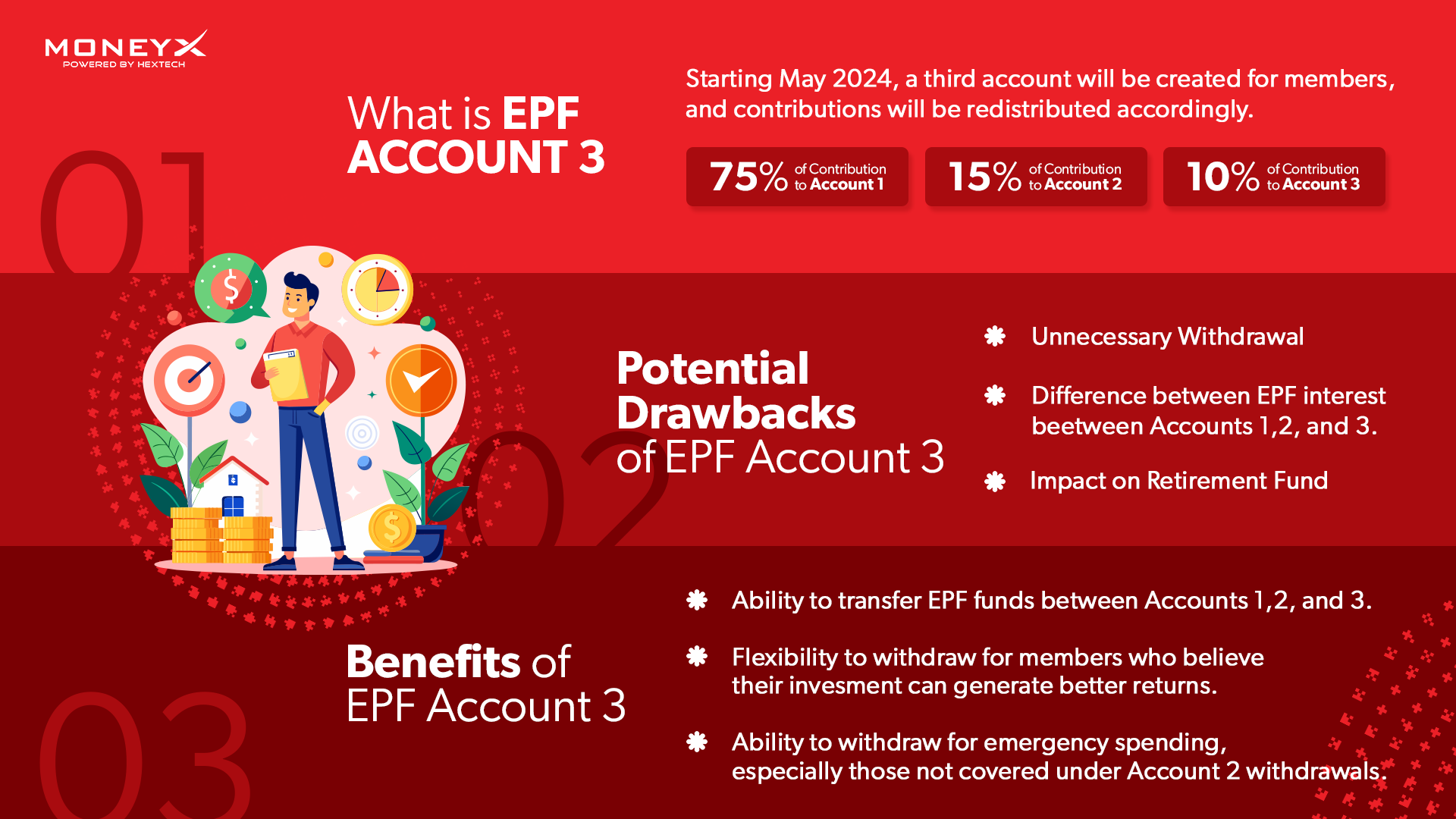

It’s been a while since EPF introduced Account 3 (Akaun Fleksibel), and you might still have questions about withdrawals. This new account channels 10% of your contributions for short-term needs, while the rest goes towards retirement and mid-term goals. But how do you withdraw from Account 3? We’ll break it down for you.

For those who are wondering what Account 3 is:

Let’s get down to business. The question on everyone’s mind: how to withdraw from your EPF Account 3.

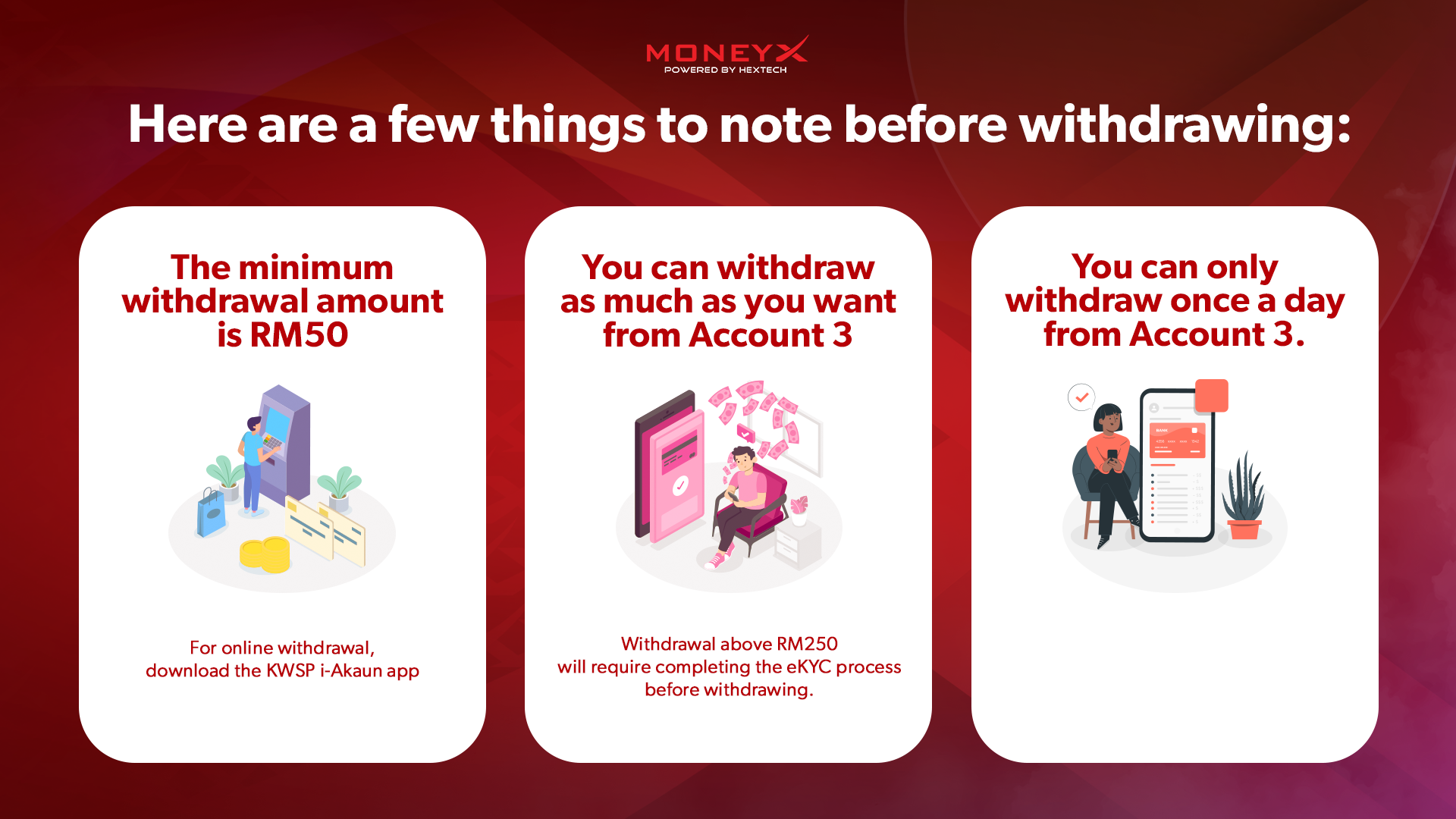

Here are a few things to note before withdrawing:

Here’s how you withdraw money from Account 3

- Login to your KWSP i-Akaun.

- Tap on the withdrawal button on the bottom of the screen and select withdraw your savings.

- Select Akaun Fleksible and select Withdraw Now. (Note: You’ll not be able to withdraw money if you do not have a minimum of RM50).

- Enter the amount you wish to withdraw and select continue.

- Key in or update your bank details to receive the funds and select continue. For this transaction to be successful the bank account must be registered under your name.

- Read the Members Declaration and Select Accept to continue.

- Key in the TAC number to continue. A confirmation page will appear upon successful transfer.

Source: EPF

One Time Transfer to Account 3

Account 3 will begin with RM0 in the account. This means that it will take some time for it to accumulate enough savings for members to withdraw.

Source: EPF

One time transfer allowed from Account 2 to Account 3

You can make an initial one-time transfer from your Account 2 to Account 3 from 11 May 2024 to 31 August 2024.

By initiating this transfer, you could withdraw funds from Account 3 immediately instead of waiting for your contribution to Account 3 to meet the minimum amount.

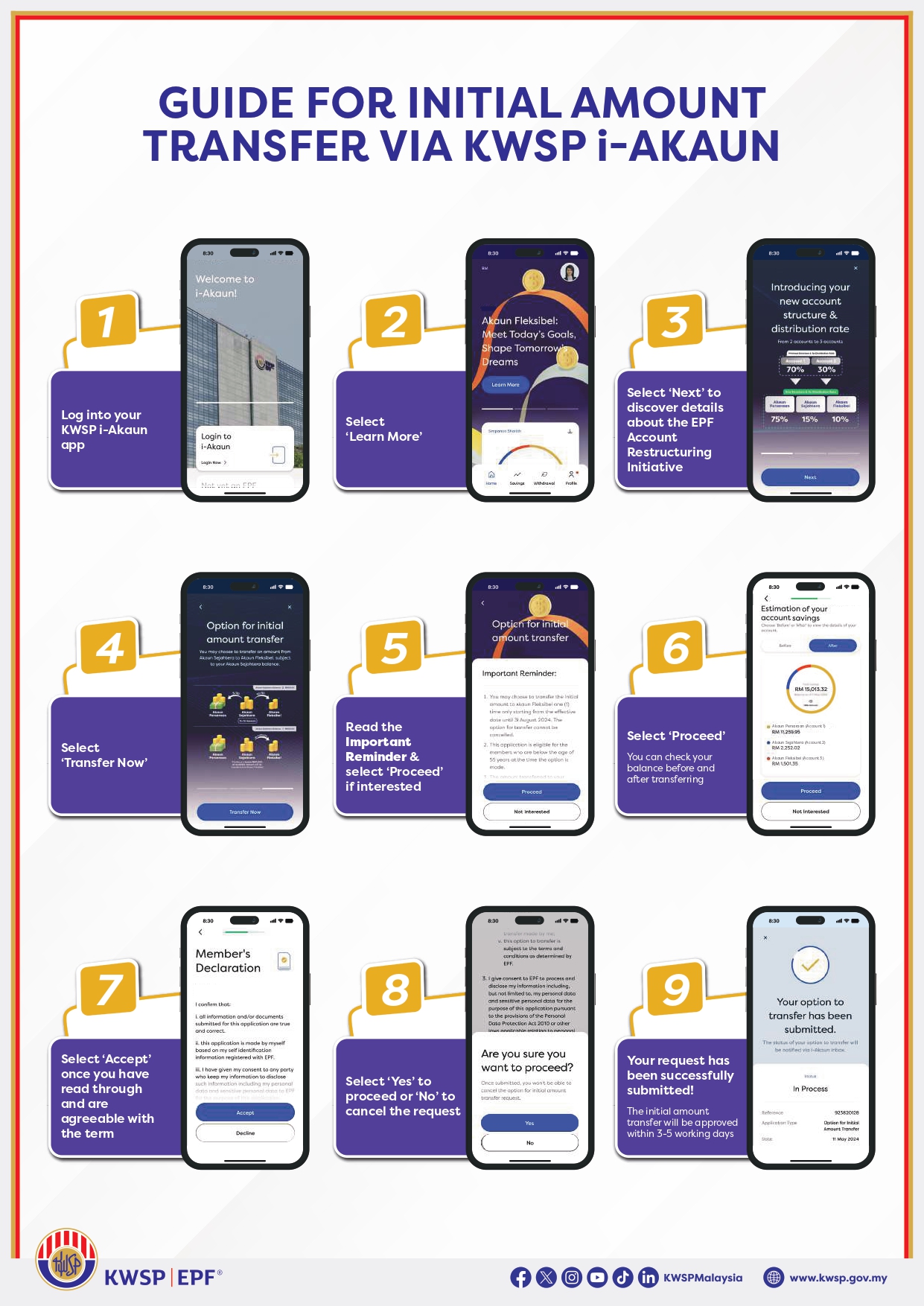

Here’s a guide on how to transfer funds to your Account 3

- Download the KWSP i-akaun if you haven’t. After launching the app, on the home screen you should be able to see “Learn about your Akaun Flesksibel”. Click on “View Details”.

- The ap will go through a visual explanation of the new EPF account restructuring. Cick on “Next” to continue.

- The app will then highlight the option for the initial amount transfer which can be performed once only from 12 May 2024 till 31 August 2024. If you wish to opt for the transfer, click on “Continue”.

- For better understanding, the KWSP i-akaun provides a BEFORE and AFTER calculation of your EPF account balances after the one-time transfer is performed. Tap on “Continue”.

- To confirm your transfer, you will need to make a final member’s declaration by reading the terms that tou are certain to perform this transfer. You need to click on “Accept” and then click on “Yes” to confirm your transfer.

- Once the submission is completed, you’ll see a confirmation page with a confirmation number. Your transfer should be completed within 7 working days upon application approval.

Source: EPF

What should you know about the one-time transfer?

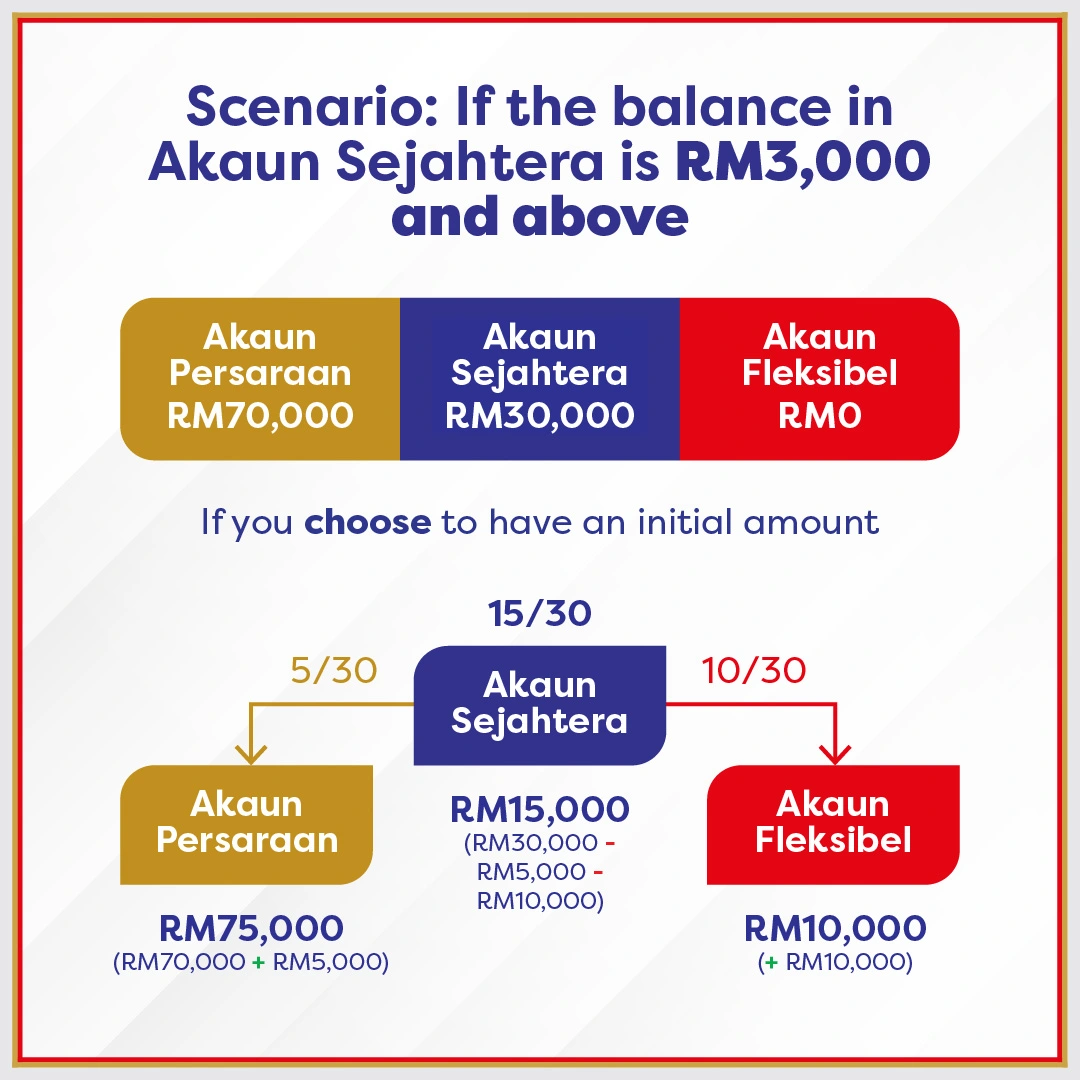

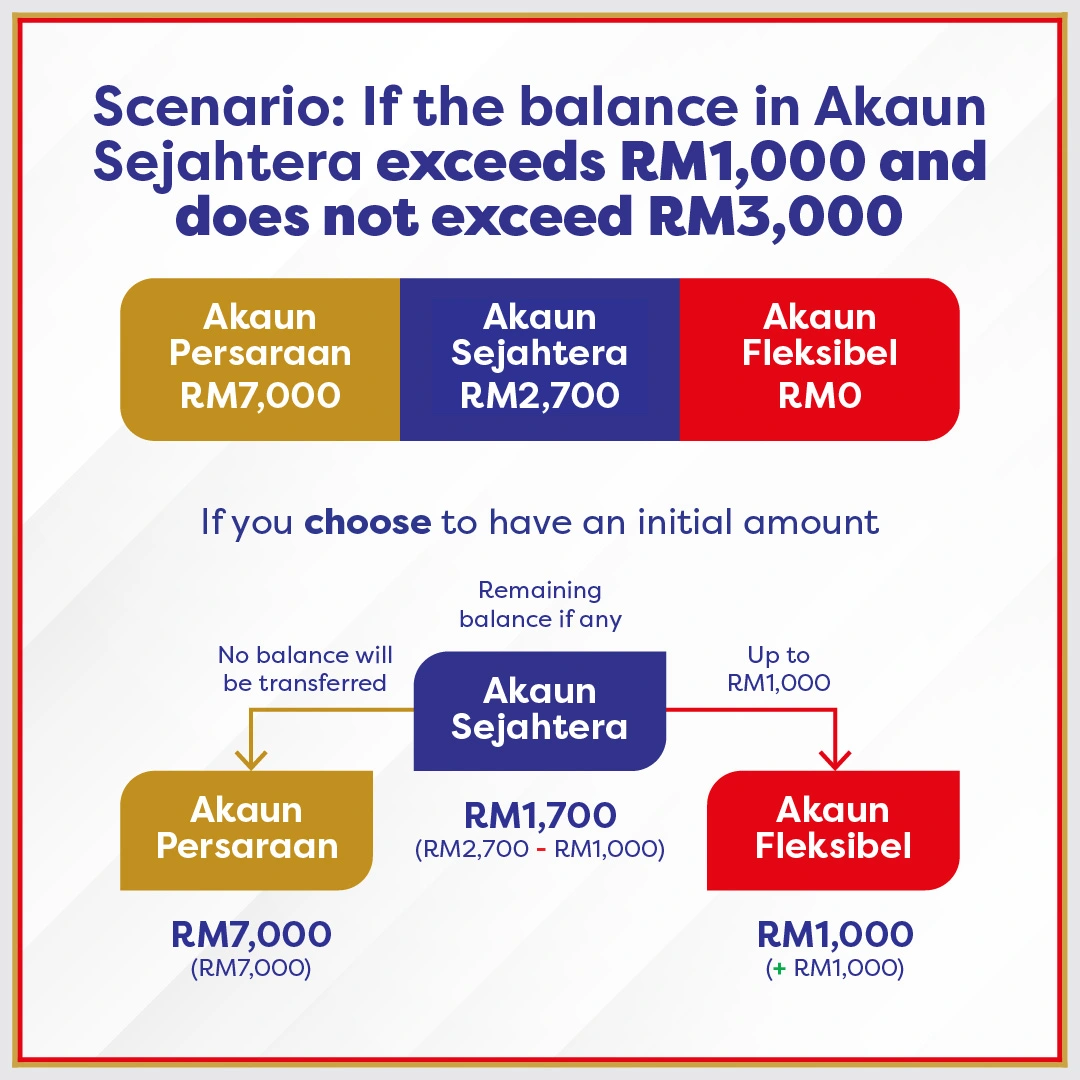

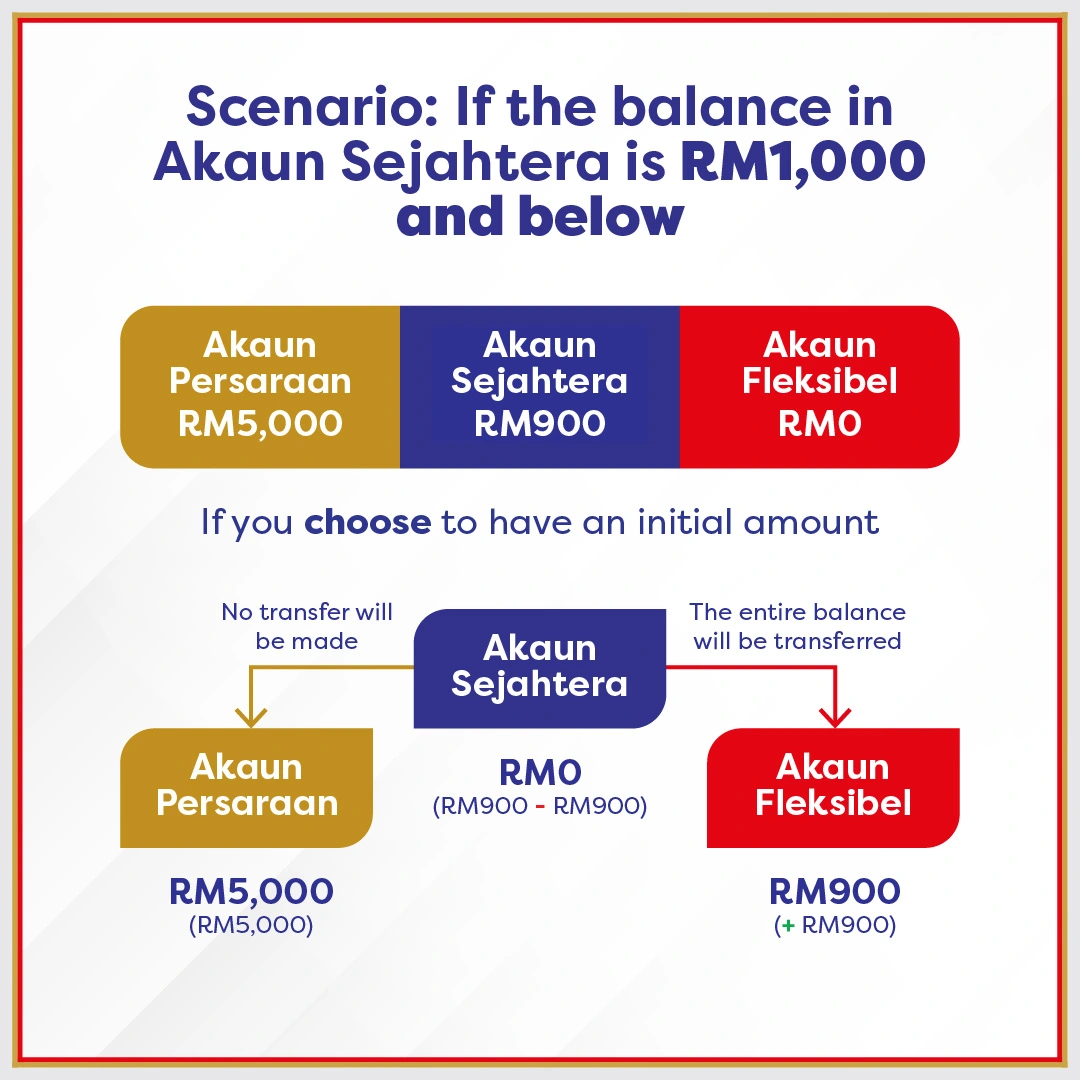

The amount that will be transferred to your account 3 depends on your current balance in Account 2.

Here’s an example of how the transfer distribution works.

Source: EPF

Application cannot be canceled once submitted

Between 12 May 2024 and 31 August 2024, each member can only make one application for the initial amount transfer.

In addition to the Account Fleksibel initial transfer, the EPF restructuring offers a wider range of opportunities. Dive deeper into the full EPF restructuring breakdown here Everything you need to know about EPF account 3.

The EPF account restructuring offers a coin with two sides. While it gives you more control over your savings for short-term needs, it’s important to remember the long-term impact on your retirement. EPF savings benefit from compounded interest over time, making it a valuable investment. Understanding the full restructuring details will help you make the best choices for your future. This will help balance meeting your current needs and building a secure retirement.